You can absolutely finance through a dealer if you so choose, and many consumers opt to go this route when purchasing a car, be it new or old. Here are the key points to consider when you're planning to purchase a new or used car. Whether you opt for a modern model or you go for a classic beauty, there are things you need to know going into the process. So you need to take great care to select a vehicle that suits both your budget and your purposes. Automobiles don't gain value (unless you get a classic and restore it, but even then you're probably putting a lot of money into the project). This purchase entails a major expense, and although many consumers assume that a vehicle is an asset, the truth is that you're paying for a tool, plain and simple, one that transports you from point A to point B. If you've never purchased an automobile before, or even if you have, you should know that the process is anything but simple. The national average interest rate is 5.27% on a 60-month loan ( source), so the better your credit profile, the lower the interest rate you can expect.What You Need to Know When Buying a Vehicle You want the lowest interest rate possible on your auto loan. What is a reasonable interest rate on a car loan? It is recommended that you make a down payment on your loan. However, the higher your down payment, the more equity you will have in your car from the beginning. In some circumstances, you’ll be able to secure an auto loan with no money down. What is the minimum down payment for a car loan?

The amount you qualify for will depend on your income and credit score. Frequently asked questions about car loan payments How much car can I qualify for? Also, Alaska, Delaware, Montana, New Hampshire, and Oregon have no sales tax on autos. Currently, California, the District of Columbia, Hawaii, and Michigan allow no trade-ins deductions when calculating sales tax. If this box is unchecked, sales tax is calculated on the purchase price less trade-in.

#AUTO LOAN FINANCE CALCULATOR FULL#

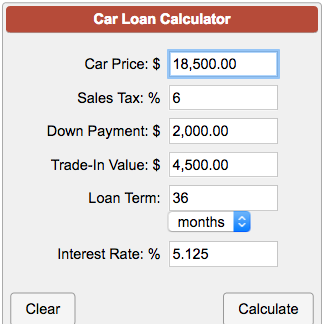

If you live in a state where your sales tax is calculated on your full purchase price, check this box. This includes the sales tax percentage rate charged on this purchase. Usually, your title transfer fees or any other fees due at delivery and are taxable are included. This includes any additional fees that are subject to sales tax. It usually includes document fees or fees that may be due at delivery and are not taxable. This refers to any additional fees that are not subject to sales tax. This is the total loan balance still outstanding on your trade-in. See the definition for “No sales tax deduction for trade-in” for more information on trade-in vehicles and sales tax. In some states, a trade-in can also reduce the amount of sales tax you will owe. This is the total amount you are given for any automobile you trade-in as part of this purchase. You can also have more flexibility in your vehicle purchase price by putting money down or using rebates. The larger your cash down payment, the smaller the loan you will need to finance this purchase. This includes the total amount of cash and/or factory rebates used in this purchase. Your monthly payment will include the interest payments you’re making on your vehicle as well. This is the annual loan interest rate for your auto loan. This is the number of months you will make payments on your loan until it is paid off in full. It will be calculated for you and included in your total after-tax price. This price doesn’t include sales tax in this amount. This is the total cost of your auto purchase, including the vehicle’s cost, additional options, and destination charges. Your monthly car payment includes your principal balance, interest and other add ons that you’re financing. This is the amount you can expect to pay each month of the length of your loan. Here are the terms you’ll see above in the calculator. To make the best use of this car payment tool, you want to have a solid understanding of all relevant terms.

0 kommentar(er)

0 kommentar(er)